Medical Expenses Tax Relief Form . Medical expenses in excess of the maximum. What medical expenses can you deduct for yourself, spouse, parents or. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Updated list of medical tax reliefs. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Tax treatment of medical expenses for companies entitled to concessionary taxation.

from www.formsbank.com

You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. Updated list of medical tax reliefs. Medical expenses in excess of the maximum. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Tax treatment of medical expenses for companies entitled to concessionary taxation. What medical expenses can you deduct for yourself, spouse, parents or. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief.

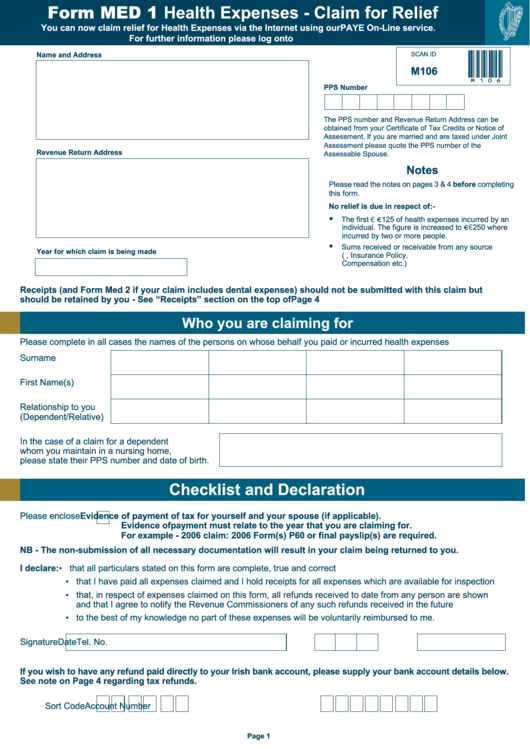

Fillable Form M106 Health Expenses Claim For Relief printable pdf

Medical Expenses Tax Relief Form If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Medical expenses in excess of the maximum. Updated list of medical tax reliefs. What medical expenses can you deduct for yourself, spouse, parents or. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Tax treatment of medical expenses for companies entitled to concessionary taxation. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower;

From studylib.net

Form Med 1 Health Expenses Claim for Relief Medical Expenses Tax Relief Form Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. What medical expenses can you deduct for yourself, spouse, parents or. You are eligible for personal reliefs and rebates. Medical Expenses Tax Relief Form.

From www.dmtax.ca

All You Need To Know About Claiming Medical Expenses On Your Personal Medical Expenses Tax Relief Form Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; What medical expenses can you deduct for yourself, spouse, parents or. You are eligible for personal reliefs and rebates. Medical Expenses Tax Relief Form.

From www.formsbank.com

Fillable Form M106 Health Expenses Claim For Relief printable pdf Medical Expenses Tax Relief Form Tax treatment of medical expenses for companies entitled to concessionary taxation. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. What medical expenses can you deduct for yourself, spouse, parents or. Tax relief of up to 37% of your annual nti, or the cpf. Medical Expenses Tax Relief Form.

From www.sampleforms.com

FREE 11+ Medical Expense Forms in PDF MS Word Medical Expenses Tax Relief Form Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; Medical expenses in excess of the maximum. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. Tax treatment of medical expenses for. Medical Expenses Tax Relief Form.

From www.uslegalforms.com

CA ABP 16783 GRMH 20152022 Fill and Sign Printable Template Online Medical Expenses Tax Relief Form Medical expenses in excess of the maximum. Updated list of medical tax reliefs. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Employers implementing pmbs can enjoy tax deduction for medical expenses. Medical Expenses Tax Relief Form.

From www.sampletemplates.com

FREE 8+ Sample Expense Forms in PDF MS Word Medical Expenses Tax Relief Form Tax treatment of medical expenses for companies entitled to concessionary taxation. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions. Medical Expenses Tax Relief Form.

From www.sampleforms.com

FREE 11+ Medical Expense Forms in PDF MS Word Medical Expenses Tax Relief Form Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. What medical expenses can you deduct for yourself, spouse, parents or. Medical expenses. Medical Expenses Tax Relief Form.

From www.aklerbrowning.com

Claiming medical expenses for 2021 Akler Browning LLP Medical Expenses Tax Relief Form Medical expenses in excess of the maximum. Updated list of medical tax reliefs. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. Tax relief of up to. Medical Expenses Tax Relief Form.

From www.formsbank.com

Fillable Form Av9 Application For Property Tax Relief 2018 Medical Expenses Tax Relief Form You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of. Medical Expenses Tax Relief Form.

From templates.udlvirtual.edu.pe

Free Printable Medical Expense Log Printable Templates Medical Expenses Tax Relief Form Medical expenses in excess of the maximum. Updated list of medical tax reliefs. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; If you’re. Medical Expenses Tax Relief Form.

From studylib.net

Form MED 1 Health Expenses Claim for Relief Medical Expenses Tax Relief Form Medical expenses in excess of the maximum. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Tax relief of up to 37% of your annual. Medical Expenses Tax Relief Form.

From www.irishtaxrebates.ie

Tax Relief on Prescriptions & Medical Expenses Irish Tax Rebates Medical Expenses Tax Relief Form What medical expenses can you deduct for yourself, spouse, parents or. If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. Tax treatment of medical expenses for companies. Medical Expenses Tax Relief Form.

From www.templateroller.com

Form MED1 Fill Out, Sign Online and Download Fillable PDF, Ireland Medical Expenses Tax Relief Form You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. What medical expenses can you deduct for. Medical Expenses Tax Relief Form.

From www.prioritytaxrelief.com

Understanding Eligible Medical Expenses Priority Tax Relief Medical Expenses Tax Relief Form You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Updated list of medical tax reliefs. Medical expenses in excess of the maximum. What medical expenses can you deduct for yourself, spouse, parents or. Tax treatment of medical expenses for companies entitled to concessionary taxation. If you’re a caregiver, you may be eligible. Medical Expenses Tax Relief Form.

From www.sampleforms.com

FREE 11+ Medical Expense Forms in PDF MS Word Medical Expenses Tax Relief Form Medical expenses in excess of the maximum. Tax treatment of medical expenses for companies entitled to concessionary taxation. You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Employers implementing. Medical Expenses Tax Relief Form.

From www.searche.co.za

How to Claim Medical Expenses On Your Tax Return Medical Expenses Tax Relief Form If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. What medical expenses can you deduct for yourself, spouse, parents or. Updated list of medical tax reliefs. Medical expenses in excess of the maximum.. Medical Expenses Tax Relief Form.

From mavink.com

Medical Expense Forms Free Printable Medical Expenses Tax Relief Form Tax treatment of medical expenses for companies entitled to concessionary taxation. Tax relief of up to 37% of your annual nti, or the cpf annual limit of $37,740, whichever is lower; Employers implementing pmbs can enjoy tax deduction for medical expenses up to 2% of total employees’ remuneration if they meet the. Updated list of medical tax reliefs. You can. Medical Expenses Tax Relief Form.

From www.formsbank.com

Top 9 Medical Expense Spreadsheet Templates free to download in PDF format Medical Expenses Tax Relief Form You are eligible for personal reliefs and rebates if you are a singapore tax resident and if you fulfilled the qualifying conditions of the reliefs. If you’re a caregiver, you may be eligible for grants, levy concession, and tax relief. You can also earn deductions by contributing to your cpf via the retirement sum topping up (rstu). Employers implementing pmbs. Medical Expenses Tax Relief Form.